Real-world asset (RWA) tokenization has gained huge momentum over the past few years and has an estimated market worth trillions of dollars. This surge in popularity can be attributed to the growth of DeFi

protocols and the burgeoning interest from financial institutions and governments in bringing financial instruments on-chain.

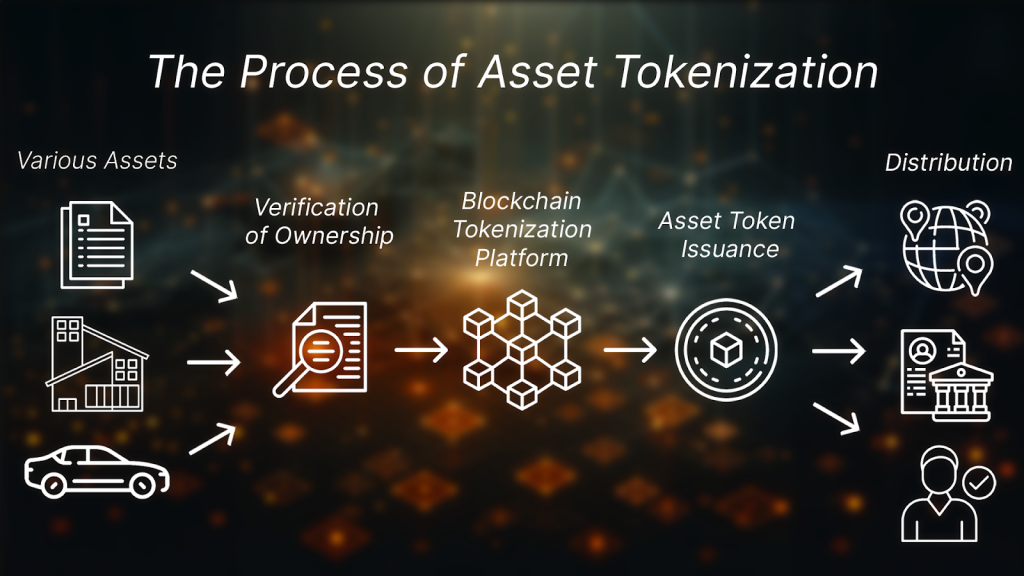

Through tokenization and blockchain technology, virtual counterparts of physical assets such as property, art, treasuries, and even luxury items like watches and jewelry can be created. This transformative process, known as asset tokenization or digitization, entails converting rights to assets into digital tokens. These tokens can be securely and reliably bought, sold, and traded using blockchain technology, effectively increasing liquidity as well as lowering costs and transaction times across markets.

RWA tokenization is poised to drive greater efficiency, accessibility, and transparency across global financial markets, and its growth can be largely attributed to the rise of DeFi protocols and increasing interest from financial institutions and governments. As we have explored in this primer, the digitization of traditional assets through blockchain technology is revolutionizing how we perceive, access, and interact with financial systems and currency.

From real estate to art and jewelry, commodities and gems, intellectual property and luxury goods, RWA tokenization is unlocking previously inaccessible markets, democratizing investment opportunities, and fostering greater liquidity and efficiency. This paradigm shift is not only reshaping traditional investment practices but also paving the References and Further Reading way for innovative financial products and services that were once unimaginable.